Manhattan Municipal Bonds - Risks are Rising

Ultra high net worth investors in Manhattan should be diversifying their municipal bond portfolios away from New York City issuers.

The risks to Manhattan municipal bonds are rising. However, there's not much anyone can do about the causes of these risks. Thus, attorneys and others living and working in or near Manhattan should eliminate those bonds from their portfolios and diversify elsewhere.

Manhattan Municipal Bonds

Municipal bonds have long been a staple in the portfolios of ultra high net worth individuals and families. Last year, I wrote a book about how risks are increasing for municipal bonds.While my book highlighted the increasing risk to municipal bonds generally, I believe those risks are rising for Manhattan residents in particular. New York City municipal bond issuers are facing a number of secular risks, including: environmental, large and rising pension obligations, increasing health care obligations, and net outmigration.

U.S. Migration Patterns

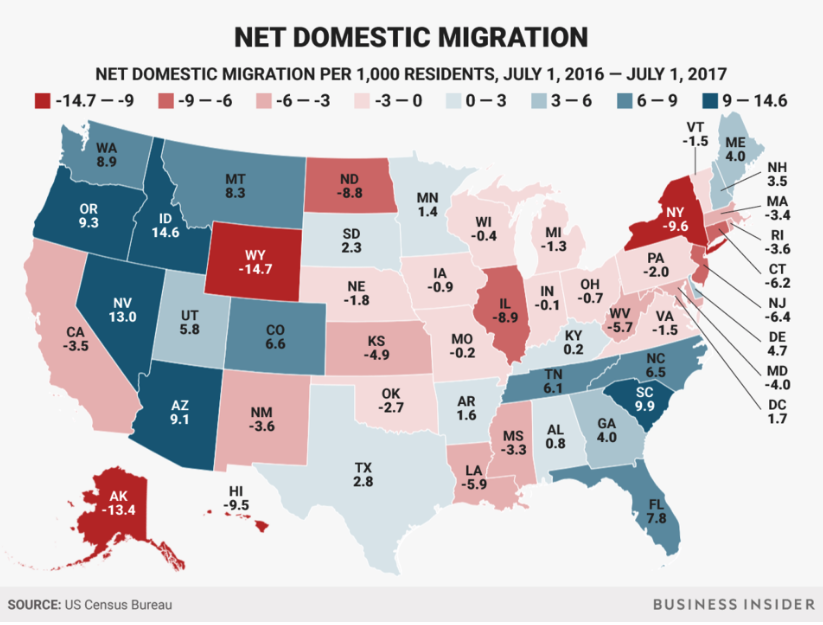

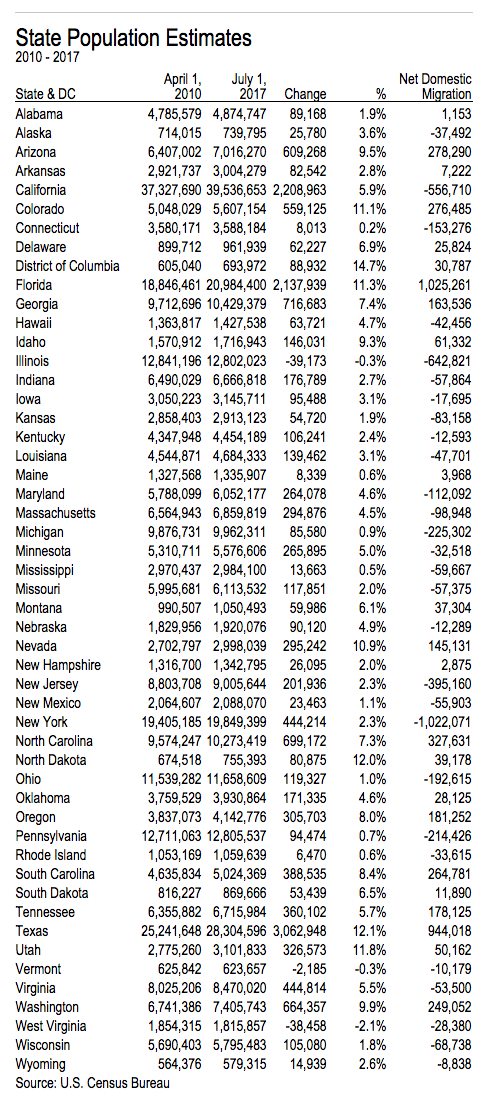

In short, New York and California are experiencing net outmigration and Florida and Texas are experiencing net inmigration. The reason, if you believe The Wall Street Journal, is purely due to taxes. New York and California are high tax states while Florida and Texas have no state income tax (they do have higher property taxes). However, the cause is also demographic, which is just as worrisome. As the workforce ages, baby boomers are retiring and moving south, for the weather and for lower taxes. A shrinking tax base is bad for business, tax revenue, and the remaining residents.Table 1: Net Domestic Migration - 2010-2017

De-Risking

As I've discussed here and here, ultra high net worth investors in Manhattan should be diversifying their municipal bond portfolios away from New York City issuers. They almost certainly have multiple Company Town Risk exposures and are not being compensated for taking them.

Bantam Financial Planning Services

We offer completely personalized, professionally designed and bound Family Strategy Books, which go miles beyond what is commonly referred to as "financial planning".